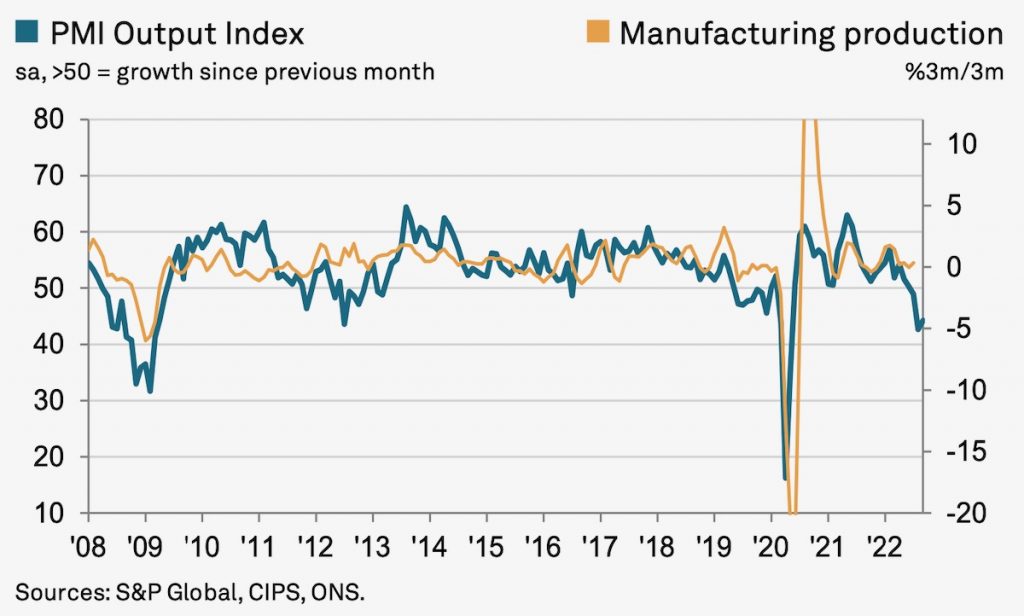

September saw a third successive contraction in UK manufacturing output as firms experienced continued reduction in new orders and reported accelerating rates of inflation for input costs and output charges.

Although the seasonally adjusted S&P Global / CIPS UK Manufacturing Purchasing Managers’ Index rose slightly to 48.4 last month, industry commentators feel there is little reason for sector optimism.

The report says manufacturers linked lower production to a reduction in new work intakes and there were reports of expected orders being postponed or cancelled due to factors such as rising uncertainty, inflationary pressure and the cost-of-living crisis. Meanwhile new export business contracted at the quickest pace since May 2020.

Higher input costs were generally attributed to raw material shortages, sustained global commodity price inflation, cost pressures at suppliers, rising energy and transportation costs and exchange rate factors. Output charge increases were mainly the result of the pass through of high costs to clients.

Despite the ongoing challenges, manufacturers maintained a positive outlook according to the report which says around half forecast that their output would be higher one year from now, as planned investments, new product launches and hopes for a calmer economic backdrop are expected to lead to an influx of new contracts.

However S&P Global Market Intelligence director Rob Dobson said: “With existing headwinds from the cost-of-living crisis likely to be exacerbated by the current volatility in financial markets, growing economic uncertainty and further increases in borrowing rates, the industrial sector is likely to remain in the doldrums during the coming quarter to add to deepening recession risks.”

MHA partner Richard Powell noted: “Dramatic increases in inflation, coupled with the plummeting value of the pound and prohibitive energy prices, have put increasing pressure on business margins and eroded fragile confidence in the sector as the economy heads towards what seems to be an inevitable recession.

He said the recent mini-Budget provided a few reasons for optimism, such as the extension to the £1 million Annual Investment Allowance and scrapping of planned increase in Corporation Tax, as well as the six month energy price cap on the wholesale cost of gas and electricity.

But he added: “The sector desperately needs the government to introduce immediate measures that will bring short term sector stability, alongside new incentives for greater business investment in areas such as green technology and AI. This must be underpinned by much-needed financial support such as government-support loans, like those seen during the pandemic, to give manufacturers the best chance of coming through coming economic storm intact.”

Accounting firm PwC UK’s manufacturing and automotive leader Cara Haffey said companies are focusing, rightly, on the long term and commented: “We continue to encourage manufacturers to invest in decarbonising their businesses and supply chains and to continue their progress on digitalisation.”