UK manufacturing production grew at the fastest rate since last summer in February, aided by stronger domestic demand, fewer raw material shortages and easing global supply chain pressures, new figures show.

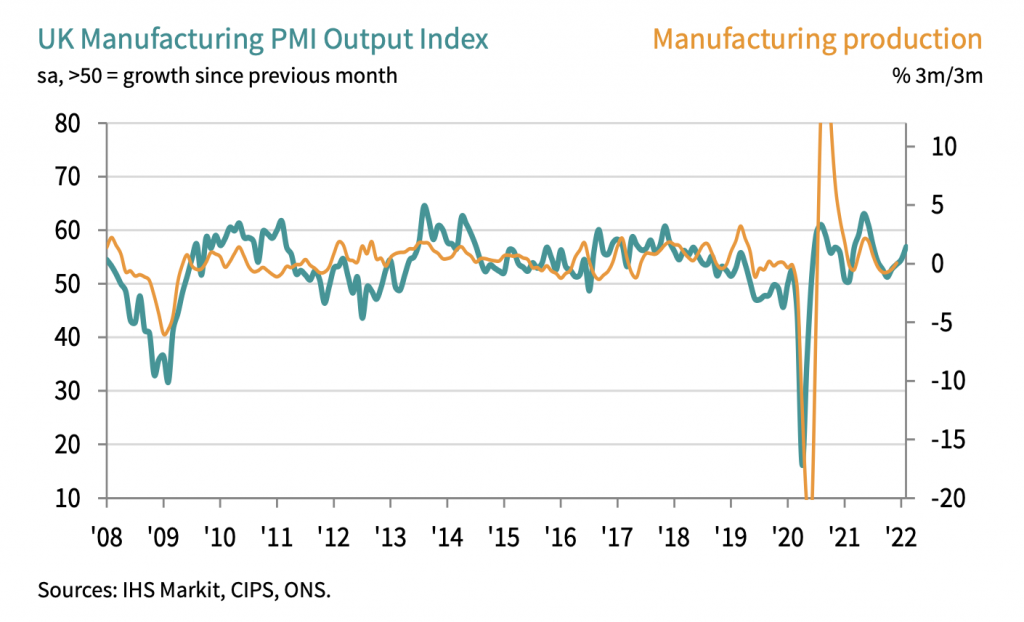

Last month’s accelerated growth of output helped lift the seasonally adjusted IHS Markit / CIPS Purchasing Managers’ Index to a three month high of 58.0, up from 57.3 in January. The PMI has now remained above the neutral 50.0 mark for 21 successive months.

Optimism also continues to rise in the sector with almost 64% of survey respondents forecasting that production will increase over the coming 12 months amid strong order pipelines and lower levels of domestic pandemic-related restrictions.

Although input price inflation remains elevated, the latest survey also signalled that cost increases were starting to moderate, while supply chain disruptions are showing signs of having passed their peak.

However new export business decreased for the fifth time in the past six months and there are warnings that the current geopolitical situation triggered by the Russian invasion of Ukraine could hit demand and confidence in the sector.

“February saw rates of expansion in UK manufacturing production and new orders both accelerate,” said IHS Markit director Rob Dobson. “Growth was boosted by stronger domestic demand and by firms catching up on delayed work as material shortages and supply chain disruptions started to dissipate.

“However, the trend in new export orders is less positive, slipping back into contraction after January’s short lived uptick. While companies maintain a positive outlook for the year ahead, rising headwinds, especially the intensifying geopolitical backdrop, are ratcheting up near-term risks to demand and confidence.”

Chartered Institute of Procurement & Supply group director Duncan Brock added that, as the Ukrainian crisis deepens, “the potential for higher commodity prices, disruptions to supply and economic pain must be considered by businesses as they try to build resilience into their supply chains in the coming months”.

In addition he pointed out that survey respondents cited “Brexit obstacles and an overspill of pandemic supply issues acting as a brake on export opportunities with clients seeking alternative sources”.

Meanwhile it was noted that ongoing inflationary pressure left manufacturers hit by rising transportation, energy and raw material prices, but rates of inflation for input costs and output charges are continuing to ease. Mr Dobson said: “Although this easing may have provided some temporary respite, signs that energy and oil prices may stay high is a further cause for concern.”

The sector’s improved output and new order growth, alongside rising business optimism, underpinned job creation in February with employment increasing for the fourteenth month in a row. This supported a reduction in backlogs of work, which fell for the first time in 16 months.