British manufacturers have made a strong start to 2018, with healthy output and order balances and a positive outlook for investment and recruitment being reported by the sector in a new survey.

British manufacturers have made a strong start to 2018, with healthy output and order balances and a positive outlook for investment and recruitment being reported by the sector in a new survey.

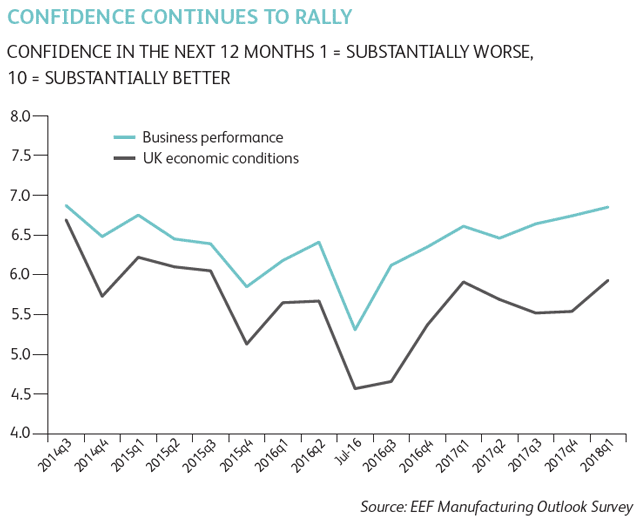

The Manufacturing Outlook Q1 survey – carried out by manufacturers association EEF and accountancy and business advisory firm BDO LLP – highlights continuing improvement in global demand as well as a pick-up in the UK market.

According to the survey, the outlook for both output and total orders remained positive in the first quarter of 2018.

Asked whether output and orders had increased or decreased in the last quarter, there was a balance (of positive minus negative answers) of +30% in each case. A balance of 32% expected orders to increase in the next three months.

The balance for export orders went down slightly to +29% (from +33% in the last quarter of Q4) but the balance for domestic orders almost doubled from +12% to +21%.

EEF chief economist Lee Hopley said: “Manufacturing activity stepped up a gear through 2017 providing industry with some decent momentum coming into this year.”

Head of BDO Manufacturing Tom Lawton added: “With healthy output and order balances and growing export demand, manufacturers are continuing to recruit and invest – providing a much needed boost to the UK economy.”

The balance of those planning to increase investment in the next quarter remained positive, but eased slightly to +18% from +20% in the last survey, while manufacturers continued to recruit heavily, with a positive balance of +21% for the past three months – close to the three-year peak seen in the second half of last year.

The manufacturing sector’s strong performance has led the EEF to upgrade its growth forecasts for manufacturing for this year from +1.4% to 2.0%. This is faster than the UK economy overall, for which the EEF is forecasting growth of 1.5% in 2018. Forecasts for 2019 also indicate further expansion for manufacturing.

However the association warns that, as talks on Brexit loom, the survey findings back its view that Government must seek an agreement with the EU that maintains trading arrangements as close as possible to those which currently exist.

European markets, the survey says, continue to drive export growth with 59% of firms reporting improving demand conditions in the EU. The next best markets of Asia and North America are seen as supportive by around a quarter of companies.

“As the chancellor sets out some thinking about longer term economic priorities in his spring statement next week, manufacturers will want to see a focus on how the new industrial strategy can help cut through Brexit uncertainty and turbocharge investment ambitions right across manufacturing supply chains,” added Mr Hopley.