ABSTRACT

The element of risk in whole life cost estimating – an essential part of financial modelling in public finance initiatives and public private partnerships – is explored.

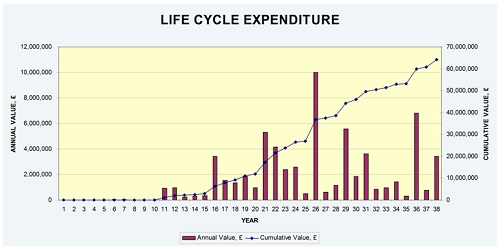

Estimating the cost of building and maintaining buildings financed by Public Finance Initiatives (PFIs) or Public Private Partnerships (PPPs) has become a subject of some controversy. Take the press coverage about the cost of replacing a 13 amp plug socket at some hospitals, which was estimated at £302. This seems like a staggering amount, but the estimate covered the cost of replacing the sockets over the full concession period, possibly as long as 42 years. Nevertheless, life costing like this is an attempt to predict the future (see Figure 1). It allows the PFI Operating Company (generally referred to as the Special Purpose Vehicle or SPV) to anticipate its maintenance and renewal costs and, therefore, to correctly predict its economical annual charge (termed the unitary payment) to the end-user.

In a report by the National Audit Office in 2008 [Making Changes in Operational PFI Projects: Report by The Comptroller And Auditor General, HC 205 Session 2007-2008, 17 January 2008] the total capital value of PFI projects was quoted at £44 billion. If we assume the whole life cost is on average 25 per cent of the capital value, the lifecycle funds required for current PFI projects are £11 billion! Consequently, any incorrect assumptions in lifecycle estimation may have a substantial effect on the future value of this sector.

The lifecycle model will be subject to careful scrutiny by the SPV, end-user client and funders alike, but for different reasons. It is in the interest of the SPV to ensure the balance of income to outgoings throughout the concession to secure their profit margin. Clients need to know that the fund will cover all requirements for renewals and refurbishments of their assets. Funders need to protect their investment and the lifecycle predictions manage ‘risk’, in that the fund exists as mitigation against anticipated future commitments.

There is a fourth group with an interest in the lifecycle: the market for secondary equity value, which kicks in after the asset has been built. There is a growing market of secondary or tertiary equity fund holders, which trade their shares in these PFI projects. This is because a financial return on PFI projects is perceived to be guaranteed and may well provide ‘a golden egg’ at the end of the project. However, this is based on the assumption that the lifecycle fund is adequate.

Assessments are made by these equity fund managers, comparing lifecycle funds against benchmarks, expressed as –

Total Lifecycle Cost / Gross Floor Area / Years of Concession (£/m²/year),

but this analysis is simplistic and can be flawed. Without a detailed lifecycle model and record of the assets being assessed, a true evaluation of the lifecycle is little more than an educated guess. Equally, the benchmarks can be simplistic, in that they are developed to represent the average hospital or school, but do not take into account local variations or special facilities – such as hydrotherapy pools – that would affect the overall lifecycle model.

The need to develop an accurate lifecycle model has spawned a small band of experts who confidently predict the issues that will affect a building over the concession period. This can be for as long as 42 years, as in the deal for St. Bartholomew’s Hospital and the London Hospital Trust. We need to consider how these models work but, more importantly, we need to assess their limitations.

The NAO Report included a quote from contract managers that lifecycle costing appeared to be ‘more of an art than a science’. To put this another way, we need to understand whether there are essential engineering principles to take into account behind the ‘smoke and mirrors’ calculations, or whether we are simply working with a crystal ball.

There are some essential engineering principles to take into account if the models are based on the correct input assumptions, which are followed throughout the concession. There should be an auditable trail between the designers, the constructors and the whole life cost modellers. But there remains an element of risk because these models are still trying to predict an uncertain future.

Firstly, we need to consider what goes into the lifecycle model, which is generally developed as part of the bid process, prior to financial close. This happens before the final design stage has been reached and well before construction starts, so the core input to the lifecycle model – including cost plan, gross area, equipment specifications and operating conditions – will not have been finalised. A lot of the detail of the final building will not be designed until later in the process, and yet some of these elements, such as major mechanical and electrical systems, will have a significant impact on the lifecycle model.

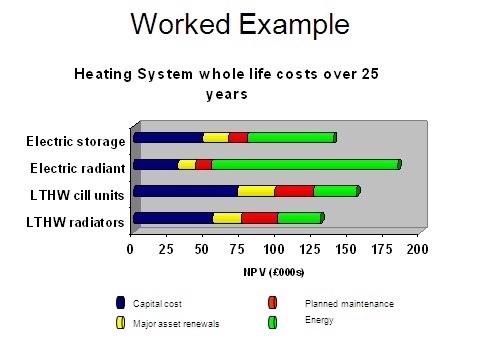

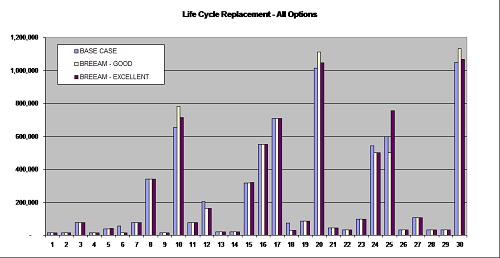

Choice of heating system is a good example. Options may vary, from ground source heat pumps, which have high capital cost but low lifecycle costs, to conventional gas boilers, which require lower initial capital costs but incur higher lifecycle costs (see Figure 2) Decisions about closed circuit television, security systems and building management systems, on the other hand, are unlikely to be made prior to financial close. However they will have high lifecycle costs and need to be taken into account at an early stage, even though there is a limited specification when the design is being outlined. A key use of lifecycle modelling in the early stages of building design is to compare design options, such as BREEAM compliance (see Figure 3).

Managing the risks

The key risk is that these late design decisions and, more importantly, ‘as built’ details may not correspond with the approved model when funding is finalised. The more astute PFI operators are well advised to get the model updated post construction to ensure that the basic design assumptions are correct. I have witnessed many cases where this has not happened and SPVs have suffered the consequences.

One simple parameter is the gross floor area of the facility, which is often used for the lifecycle metric (£/m²/year). If the final design varies from earlier assumptions, this metric may well be incorrect, along with any cost input data that is area-dependant – secondary equity fund managers beware!

Another assumption that fuels debate is the required residual life of the assets at the end of the concession period. This is generally specified by the client and should form part of the project agreement. The principle of residual life is best described as the value of the assets after hand-back, but before additional replacements or renewals are required. The lifecycle fund has to make provision for repairs and refurbishments or renewals to meet clients’ expectations. It is important to specify the condition of the asset at the end of the concession, with clearly defined and measurable parameters.

There are many other issues that can impact on the potential robustness of the lifecycle fund, including procurement policy and workmanship during construction. Lifecycle models are based on certain assumptions regarding the quality and durability of materials, as well as a minimum level of workmanship during construction. To ensure the built asset matches these assumptions, the selection of building materials and finishes, such as carpet, should reflect the duration and wear rates assumed in the lifecycle model.

Equally, the quality of build and assembly can be a source of latent defects – again, because many models are put together long before construction starts. Added to that is the fact that the construction company involved may not be focused on the longevity of the building and is unlikely to be aware of the assumptions made in the lifecycle model.

Usage requirements for the building may also change. The NAO Report quotes an estimated £180 million was paid by public authorities to PFI companies to undertake changes in 2006. I have inspected schools where the rooms designed for woodwork classes have been converted to information and communications technology rooms. The physical changes required to accommodate these new functions involve design elements, which must be reflected in the lifecycle model but will be funded as ‘changes’ by the end-user.

This is what prompted media coverage about the cost of an additional single 13 amp socket possibly being as much as £302. That was the maximum cost quoted in the NAO report, which recommends the need for transparency in all the costs for changes requested during the concession. So this charge reflects the cost of that socket over that whole concession period.

On the other hand, the design may not have reflected the actual usage of the facility –that is, operating hours or numbers of passengers or customers, which would increase wear and tear. These physical changes can be significant over the lifetime of the facility and should be reflected in the lifecycle model.

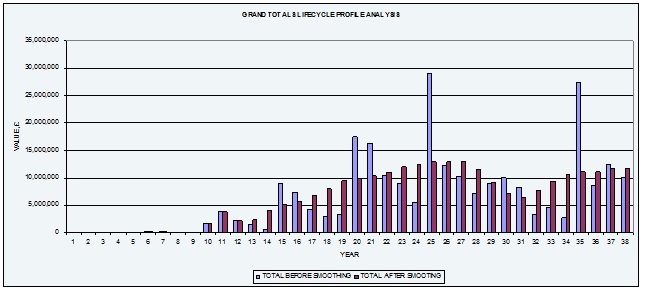

As part of the financial modelling, the lifecycle expenditure needs to be smoothed (see Figure 4) to balance debt repayments against income. Financial models take into account future inflation, although many only apply a standard rate based on a prediction using the retail prices index. It is a fact that costs of labour, materials and equipment are subject to different inflationary pressures, particularly in areas such as information technology.

It is in the interests of all parties involved in a public private partnership project to ensure that the lifecycle fund is robust when it reaches financial close. But it is important to consider the lifecycle as a live database of the assets involved throughout the concession, which needs to be maintained as changes occur along the way.

This article was originally published in Infrastructure Journal and Assets, the Magazine of the Institute of Asset Management.

The author

With over forty years of experience in engineering management and strategic consultancy projects, throughout the world, Ian has acquired substantial diverse engineering expertise in a variety of industries, managing multi-disciplinary teams, on a range of high value capital projects and engineering departments in ‘24-7’ high volume, manufacturing environments (automotive, consumer goods and food processing). He gained direct rail experience on the Channel Tunnel Rail Link project as senior mechanical and electrical field engineer. More recently, he has carried out strategic project reviews for Network Rail and TfL, focussing on the project governance processes. He has direct experience in applying risk and value management and whole life costs to a range of infrastructure sector projects.

With over forty years of experience in engineering management and strategic consultancy projects, throughout the world, Ian has acquired substantial diverse engineering expertise in a variety of industries, managing multi-disciplinary teams, on a range of high value capital projects and engineering departments in ‘24-7’ high volume, manufacturing environments (automotive, consumer goods and food processing). He gained direct rail experience on the Channel Tunnel Rail Link project as senior mechanical and electrical field engineer. More recently, he has carried out strategic project reviews for Network Rail and TfL, focussing on the project governance processes. He has direct experience in applying risk and value management and whole life costs to a range of infrastructure sector projects.

Ian is now a principal consultant in the Asset Management Group within the Business and AM Practice at CH2M Hill, London, which works across all sectors and across the globe to provide advice on the effective long-term management of assets. This includes understanding the relationship between corporate aspirations, business requirements and the management of assets and resources to support the clients’ businesses..